Card To Card Transfer¶

- Direct Integration

- Payment Form Integration

Direct Integration¶

Money transfer General Flow¶

Payneteasy supports few schemas of money transfer: Card2Card, Cash2Card or Deposit2Card. All of them could be initiated by customer itself or by Merchant using recurrent API. Simple Money transfer described in Sale Transactions for direct Card2Card transfer and in Payment Form Integration for integration by external form. Recurrent Money transfer transactions are made in three steps:

- Initial payment – make initial payment to verify and authorize credit card

- Card Registration Diagram – get cards reference ID card-ref-id and remember it

- Money transfer – run money transfer using card-ref-id from previous step. In case of transfer from registered card merchant initiates transfer using given source-card-ref-id and destination-card-no or destination-card-ref-id. In case of transfer from account merchant initiates transfer using given destination-card-no or destination-card-ref-id

- After the payment initiation Payneteasy returns new Order ID for the this transfer

- Merchant starts polling Payneteasy

- Payneteasy returns current status of the order. processing status means the order is still being processed

- Payneteasy processes the payment using appropriate bank’s gateway

- Merchant keeps polling Payneteasy by using Status API

- Payneteasy returns current status of the order - approved, declined or filtered

Money transfer URL¶

For integration purposes use staging environment sandbox.payneteasy.com instead of production gate.payneteasy.com. Sale transactions are initiated through HTTPS POST request by using URL in the following format:

Money transfer transaction by ENDPOINTID¶

The End point ID is an entry point for incoming Merchant’s transactions for single currency integration.

Money transfer transaction by ENDPOINTGROUPID¶

The End point group ID is an entry point for incoming Merchant’s transactions for multi currency integration.

Process Money Transfer¶

Money transfer request parameters¶

Note

| Money transfer request parameter | Length/Type | Comment | Necessity* |

|---|---|---|---|

| client_orderid | 128/String | Merchant order identifier. | Mandatory |

| login | 20/String | Merchant’s login | Mandatory |

| source-card-ref-id | 20/Numeric | Card reference id to source card, obtained at Card Registration step, not used for Transfer from account transactions | Optional |

| destination-card-no | 16-19/String | Card number of destination card. Mandatory if destination-card-ref-id omitted. Ignored if destination-card-ref-id is not empty | Conditional |

| destination-card-ref-id | 20/Numeric | Card reference id to destination card, obtained at Card Registration step. Mandatory if destination-card-no omitted. | Conditional |

| order_desc | 64k/String | Order description | Mandatory |

| amount | 10/Numeric | Amount to be transferred. The amount has to be specified in the highest units with . delimiter. For instance, 10.5 for USD means 10 US Dollars and 50 Cents | Mandatory |

| currency | 3/String | Currency the transaction is charged in (three-letter currency code). Example ofВ valid parameter values are: USD for US Dollar EUR for European Euro | Mandatory |

| cvv2 | 3-4/Numeric | Customer’s CVV2 code for source card. CVV2 (Card Verification Value) is a three- or four-digit number AFTER the credit card number in the signature area of the card. May be empty or absent if bank gateway supports processing without CVV2, not used for Transfer from account transactions if destination-card-no is used | Optional |

| ipaddress | 45/String | Customer’s IP address, included for fraud screening purposes. | Mandatory |

| control | 40/String | Checksum generated by SHA-1. This is SHA-1 checksum of the concatenation login + client_orderid + source-card-ref-id (if present) + destination-card-ref-id (if present) + amount_in_cents + currency + merchant_control. | Mandatory |

| first_name | 128/String | Sender first name, not used for Transfer from account transactions if destination-card-no is used | Optional |

| middle_name | 128/String | Sender middle name, not used for Transfer from account transactions if destination-card-no is used | Optional |

| last_name | 128/String | Sender last name, not used for Transfer from account transactions if destination-card-no is used | Optional |

| ssn | 32/Numeric | Last four digits of the Sender’s social security number, not used for Transfer from account transactions if destination-card-no is used. Mandatory for some acquirers for cross-country transfers. | Conditional |

| birthday | 8/Numeric | Sender date of birth, in the format MMDDYY, not used for Transfer from account transactions if destination-card-no is used | Optional |

| address1 | 50/String | Sender address line 1, not used for Transfer from account transactions if destination-card-no is used | Optional |

| city | 50/String | Sender city, not used for Transfer from account transactions if destination-card-no is used | Optional |

| state | 2-3/String | Sender’s state . Please see Reference for a list of valid state codes, not used for Transfer from account transactions if destination-card-no is used. Mandatory for USA, Canada and Australia. | Conditional |

| zip_code | 10/String | Sender ZIP code, not used for Transfer from account transactions if destination-card-no is used | Optional |

| country | 2/String | Sender country(two-letter country code). Please see Reference for a list of valid country codes, not used for Transfer from account transactions if destination-card-no is used | Optional |

| phone | 15/String | Sender full international phone number, including country code, not used for Transfer from account transactions if destination-card-no is used | Optional |

| cell_phone | 15/String | Sender full international cell phone number, including country code, not used for Transfer from account transactions if destination-card-no is used | Optional |

| 50/String | Sender email address, not used for Transfer from account transactions if destination-card-no is used | Optional | |

| purpose | 128/String | Destination to where the payment goes. It is useful for the merchants who let their clients to transfer money from a credit card to some type of client’s account, e.g. game or mobile phone account. Sample values are: +7123456789; gamer0001@ereality.com etc. This value will be used by fraud monitoring system. | Optional |

| receiver_first_name | 128/String | Receiver first name | Optional |

| receiver_middle_name | 128/String | Receiver middle name | Optional |

| receiver_last_name | 128/String | Receiver last name | Optional |

| receiver_resident | Boolean (true/false) | Is receiver a resident? | Optional |

| redirect_url | 1024/String | URL the cardholder will be redirected to upon completion of the transaction. Please note that the cardholder will be redirected in any case, no matter whether the transaction is approved or declined. You should not use this parameter to retrieve results from Payneteasy gateway, because all parameters go through client’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead. | Optional |

| redirect_success_url | 1024/String | URL the cardholder will be redirected to upon completion of the transaction. Please note that the cardholder will be redirected only in case if the transaction is approved. You should not use this parameter to retrieve results from Payneteasy gateway, because all parameters go through client’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead. | Optional |

| redirect_fail_url | 1024/String | URL the cardholder will be redirected to upon completion of the transaction. Please note that the cardholder will be redirected only in case if the transaction is declined or filtered. You should not use this parameter to retrieve results from Payneteasy gateway, because all parameters go through client’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead. | Optional |

| server_callback_url | 1024/String | URL the transaction result will be sent to. Merchant may use this URL for custom processing of the transaction completion, e.g. to collect sales data in Merchant’s database. See more details at Merchant Callbacks | Optional |

Additional fields for money transfer transactions¶

Note

Browser data for 3DS 2.X is gathered by Payneteasy system on 3DS authentication stage. For some processing channels, however, the browser data and/or merchant URL for 3DS challenge results must be provided in initial transaction request. Please contact Support manager to clarify if these parameters should be included in request parameters.

The merchant’s site needs to accurately populate the browser information for each transaction. This data can be obtained by merchant’s servers. Ensure that the data is not altered or hard-coded, and that it is unique to each transaction.

| Field Name | Length/Type | Description | Conditional Inclusion |

|---|---|---|---|

| tds_areq_notification_url, alias tds_cres_notification_url | 256/String | Fully qualified URL of merchant system that will receive the CRes message or Error Message. This CRes message must be sent to Payneteasy. See details here Upload CRes Result | Optional |

| customer_browser_info | Boolean | If true, then the fields below must be present | Optional |

| ipaddress | 45/String | IP address of the browser as returned by the HTTP headers to the 3DS Requestor | Required |

| customer_browser_accept_header | 2048/String | Exact content of the HTTP accept headers as sent to the 3DS Requestor from the Cardholder’s browser | Required |

| customer_browser_color_depth | 2/String | Value representing the bit depth of the colour palette for displaying images, in bits per pixel | Required when browser_javaScript_enabled = true; otherwise Optional |

| customer_browser_java_enabled | Boolean | Boolean that represents the ability of the cardholder browser to execute Java | Required when browser_javaScript_enabled = true; otherwise Optional |

| customer_browser_javascript_enabled | Boolean | Boolean that represents the ability of the cardholder browser to execute JavaScript | Required |

| customer_browser_accept_language | 8/String | Value representing the browser language as defined in IETF BCP47 | Required |

| customer_browser_screen_height | 6/Numeric | Total height of the Cardholder’s screen in pixels | Required when browser_javaScript_enabled = true; otherwise Optional |

| customer_browser_screen_width | 6/Numeric | Total width of the cardholder’s screen in pixels | Required when browser_javaScript_enabled = true; otherwise Optional |

| customer_browser_time_zone | 5/String | Time-zone offset in minutes between UTC and the Cardholder browser local time. Note that the offset is positive if the local time zone is behind UTC and negative if it is ahead | Required when browser_javaScript_enabled = true; otherwise Optional |

| customer_browser_user_agent | 2048/String | Exact content of the HTTP user-agent header | Required |

Transfer Response¶

Note

| Transfer response parameter | Description |

|---|---|

| type | The type of response. May be async-response, validation-error, error. If type equals validation-error or error, error-message and error-code parameters contain error details. |

| paynet-order-id | Order id assigned to the order by Payneteasy |

| merchant-order-id | Merchant order id |

| serial-number | Unique number assigned by Payneteasy server to particular request from the Merchant. |

| error-message | If status is error this parameter contains the reason for decline or error details |

| error-code | The error code is case of error status |

| end-point-id | Endpoint id used for the transaction |

Transfer Response Example¶

type=async-response

&serial-number=00000000-0000-0000-0000-00000456f9e1

&merchant-order-id=902B4FF5

&paynet-order-id=3622255

&end-point-id=212

3DS redirect¶

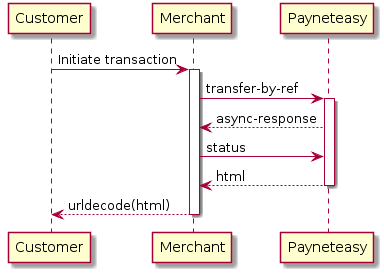

If your gate supports 3-D Secure you need to send status request and process html return parameter to send customer to 3-D Secure Authorisation. The simplified schema looks like:

html field is always present for 3DS gates in status response, whether clients card supports 3-D Secure or not.

If source-card-ref-id is specified upon completion of 3DS authorization process by the Customer he/she is automatically redirected to redirect_url. The redirection is performed as an HTTPS POST request with the parameters specified in the following table.

| Redirect parameter | Description |

|---|---|

| status | See Status List for details. |

| orderid | Order id assigned to the order by Payneteasy |

| merchant_order | Merchant order id |

| client_orderid | Merchant order id |

| error_message | If status is declined or error this parameter contains the reason for decline or error details |

| control | Checksum used to ensure that it is Payneteasy (and not a fraudster) that initiates the request. This is SHA-1 checksum of the concatenation status + orderid + client_orderid + merchant-control. |

| descriptor | Gate descriptor |

If Merchant has passed server_callback_url in original Sale request Payneteasy will call this URL. Merchant may use it for custom processing of the transaction completion, e.g. to collect sales data in Merchant’s database. The parameters sent to this URL are specified in sale, return Callback Parameters

Server callback result¶

Upon completion by the System of 3DS request processing it returns the result on the specified server_callback_url with the following parameters described in sale, return Callback Parameters

The checksum is used to ensure that the callback is initiated for a particular Merchant, and not for anybody else claiming to be such Merchant. This SHA-1 checksum, the control parameter, is created by concatenation of the parameters values in the following order:

- status

- orderid

- client_orderid

- merchant_control

A complete string example may look as follows:

approvedS279G323P4T1209294c258d6536ababe653E8E45B5-7682-42D8-6ECC-FB794F6B11B1

Encrypt the string using SHA-1 algorithm. The resultant string yields the control parameter. For the above-mentioned example the control will take the following value:

e04bd50531f45f9fc76917ac78a82f3efaf0049c

All parameters are sent via GET method.

Server callback result example¶

status=declined

&error-message=Decline, refer to card issuer

&error-code=107

&paynet-order-id=S279G323P4T1209294

&merchant-order-id=c258d6536ababe65

Order status¶

Merchant must use Order status API call to get the customer’s order transaction status. After any type of transaction is sent to Payneteasy server and order id is returned, Merchant should poll for transaction status. When transaction is processed on Payneteasy server side it returns it’s status back to Merchant and at this moment the Merchant is ready to show the customer transaction result, whether it’s approved or declined.

Status API URL¶

The End point ID is an entry point for incoming Merchant’s transactions and is actually the only Payneteasy object which is exposed via API.

Order status call parameters¶

| Status parameter | Description |

|---|---|

| login | Merchant login name |

| client_orderid | Merchant order identifier of the transaction for which the status is requested |

| orderid | Order id assigned to the order by Payneteasy |

| by-request-sn | Serial number assigned to the specific request by Payneteasy. If this field exist in status request, status response return for this specific request. |

| control | Checksum used to ensure that it is Payneteasy (and not a fraudster) that initiates the callback for a particular Merchant. This is SHA-1 checksum of the concatenation login + client-order-id + paynet-order-id + merchant-control. See Order status API call authorization through control parameter for more details about generating control checksum. |

Order Status Response¶

Note

| Status Response Parameter | Description |

|---|---|

| type | The type of response. May be status-response |

| status | See Status List for details. |

| amount | Actual transaction amount. This value can be changed during the transaction flow. |

| paynet-order-id | Order id assigned to the order by Payneteasy |

| merchant-order-id | Merchant order id |

| phone | Customer phone. |

| html | HTML code of 3DS authorization form, encoded in application/x-www-form-urlencoded MIME format. Merchant must decode this parameter before showing the form to the Customer. The Payneteasy System returns the following response parameters when it gets 3DS authorization form from the Issuer Bank. It contains auth form HTML code which must be passed through without any changes to the client’s browser. This parameter exists and has value only when the redirection HTML is already available. For non-3DS this never happens. For 3DS HTML has value after some short time after the processing has been started. |

| redirect-to | For 3DS authorization the merchant can redirect the customer to URL provided in this parameter using GET HTTP method instead of rendering the page provided in html parameter. The redirect-to parameter is returned only if the html parameter is returned. This parameter must be used to work with 3DS 2.0. |

| serial-number | Unique number assigned by Payneteasy server to particular request from the Merchant. |

| gate-partial-reversal | Processing gate support partial reversal (enabled or disabled). |

| gate-partial-capture | Processing gate support partial capture (enabled or disabled). |

| transaction-type | Transaction type (sale, reversal, capture, preauth). |

| processor-rrn | Bank Receiver Registration Number. |

| processor-tx-id | Acquirer transaction identifier. |

| receipt-id | Electronic link to receipt https://gate.payneteasy.com/paynet/view-receipt/ENDPOINTID/receipt-id/ |

| name | Cardholder name. |

| cardholder-name | Cardholder name. |

| card-exp-month | Card expiration month. |

| card-exp-year | Card expiration year. |

| card-hash-id | Unique card identifier to use for loyalty programs or fraud checks. |

| destination-hash-id | Unique card identifier to use for loyalty programs or fraud checks. |

| Customer e-mail. | |

| purpose | Destination to where the payment goes. It is useful for the merchants who let their clients to transfer money from a credit card to some type of client’s account, e.g. game or mobile phone account. Sample values are: +7123456789; gamer0001@ereality.com etc. This value will be used by fraud monitoring system. |

| bank-name | Bank name by customer card BIN. |

| last-four-digits | Last four digits of customer credit card number. |

| bin | Bank BIN of customer credit card number. |

| card-type | Type of customer credit card (VISA, MASTERCARD, etc). |

| dest-bank-name | Destination bank name by customer card BIN. |

| dest-last-four-digits | Destination last four digits of customer credit card number. |

| dest-bin | Destination bank BIN of customer credit card number. |

| dest-card-type | Type of destination customer credit card (VISA, MASTERCARD, etc). |

| terminal-id | Acquirer terminal identifier to show in receipt. |

| paynet-processing-date | Acquirer transaction processing date. |

| approval-code | Bank approval code. |

| order-stage | The current stage of the transaction processing. See Order Stage for details |

| loyalty-balance | The current bonuses balance of the loyalty program for current operation. if available |

| loyalty-message | The message from the loyalty program. if available |

| loyalty-bonus | The bonus value of the loyalty program for current operation. if available |

| loyalty-program | The name of the loyalty program for current operation. if available |

| descriptor | Bank identifier of the payment recipient. |

| error-message | If status in declined, error, filtered this parameter contains the reason for decline |

| error-code | The error code is case status in declined, error, filtered. |

| by-request-sn | Serial number assigned to the specific request by Payneteasy. If this field exist in status request, status response return for this specific request. |

| verified-3d-status | See:ref:3d_secure_status_list for details |

| verified-rsc-status | See Random Sum Check Status List for details |

| initial-amount | Amount, set in initiating transaction, without any fees or commissions. This value can’t change during the transaction flow. |

| transaction-date | Date of final status assignment for transaction. |

Order Status Response Example¶

type=status-response

&serial-number=00000000-0000-0000-0000-00000456f9e6

&merchant-order-id=902B4FF5

&processor-tx-id=PNTEST-3622257

&paynet-order-id=3622257

&status=approved

&amount=10.42

&descriptor=3D

&transaction-type=transfer

&receipt-id=93c8ea85-9126-3d72-bca2-98e999107c82

&name=CARD+HOLDER

&cardholder-name=CARD+HOLDER

&card-exp-month=12

&card-exp-year=2099

&email=john.smith%40gmail.com

&processor-rrn=511000302615

&approval-code=965452

&order-stage=transfer_approved

&merchantdata=VIP+customer

&last-four-digits=1111

&bin=444455

&card-type=VISA

&phone=12063582043

&bank-name=UNKNOWN

&dest-bank-name=CITIBANK

&dest-bin=520306

&dest-last-four-digits=9001

&dest-card-type=MASTERCARD

&paynet-processing-date=2015-04-20+22%3A53%3A37+MSK

&card-hash-id=212609

&destination-card-hash-id=212608

&verified-3d-status=AUTHENTICATED

&verified-rsc-status=AUTHENTICATED

&transaction-date=2023-01-10+12%3A46%3A28+MSK

Status request authorization through control parameter¶

The checksum is used to ensure that it is Merchant (and not a fraudster) that sends the request to Payneteasy. This SHA-1 checksum, the parameter control, is created by concatenating of the values of the parameters in the following order:

- login

- client_orderid

- orderid

- merchant_control

For example assume the following values are corresponds the parameters above:

| Parameter name | Parameter Value |

|---|---|

| login | cool_merchant |

| client_orderid | 5624444333322221111110 |

| orderid | 9625 |

| merchant_control | r45a019070772d1c4c2b503bbdc0fa22 |

The complete string example may look as follows:

cool_merchant56244443333222211111109625r45a019070772d1c4c2b503bbdc0fa22

Encrypt the string using SHA-1 algorithm. The resultant string yields the control parameter which is required for authorizing the callback. For the example control above will take the following value:

c52cfb609f20a3677eb280cc4709278ea8f7024c

Payment Form Integration¶

Payment Form integration is relevant for merchants who are not able to accept customer card details (merchant’s website must complete PCI DSS certification). In case of Payment Form integration merchant is released of accepting payment details and all this stuff is completely implemented on the Payneteasy gateway side. In addition merchant may customize the look and feel of the Payment Form. Merchant must send the template to his/her Manager for approval before it could be used.

Payment Form API URL¶

For integration purposes use staging environment sandbox.payneteasy.com instead of production gate.payneteasy.com. Payment Form transactions are initiated through HTTPS POST request by using URL in the following format:

Form Transaction by ENDPOINTID¶

The End point ID is an entry point for incoming Merchant’s transactions for single currency integration.

Form Transaction by ENDPOINTGROUPID¶

The End point group ID is an entry point for incoming Merchant’s transactions for multi currency integration.

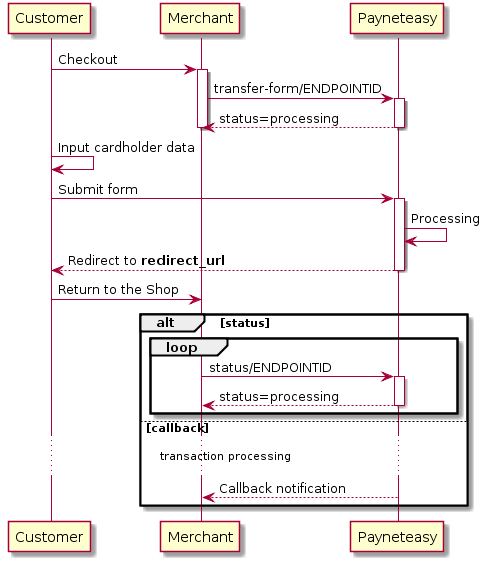

General Payment Form Process Flow¶

Payment form fields¶

This form contains the following fields:

| Form field name | Description |

|---|---|

| credit_card_number | Customer’s credit card number 4455555555555544 |

| expire_month | Credit card expiration month 01 or 12 |

| expire_year | Credit card expiration year 2016 |

| cvv2 | Card security code 432 |

Initiating a transaction with Payment Form¶

Merchant must supply the following parameters to initiate a transfer transaction using payment form template.

Payment Form Request Parameters¶

| Request parameter name | Length/Type | Comment | Necessity* |

|---|---|---|---|

| client_orderid | 128/String | Merchant order identifier. | Mandatory |

| order_desc | 64k/String | Brief order description | Mandatory |

| first_name | 50/String | Customer’s first name | Mandatory |

| last_name | 50/String | Customer’s last name | Mandatory |

| ssn | 4/Numeric | Last four digits of the customer’s social security number. | Optional |

| birthday | 8/Numeric | Customer’s date of birth, in the format YYYYMMDD. | Optional |

| address1 | 50/String | Customer’s address line 1. | Mandatory |

| city | 50/String | Customer’s city. | Mandatory |

| state | 2/String | Customer’s state (two-letter state code). Please see Country Codes for a list of valid state codes. Mandatory for USA, Canada and Australia | Conditional |

| zip_code | 10/String | Customer’s ZIP code | Mandatory |

| country | 2/String | Customer’s country(two-letter country code). Please see Country Codes for a list of valid country codes. | Mandatory |

| phone | 15/String | Customer’s full international phone number, including country code. | Mandatory |

| cell_phone | 15/String | Customer’s full international cell phone number, including country code. | Optional |

| 50/String | Customer’s email address. | Mandatory | |

| amount | 10/Numeric | Amount to be charged. The amount has to be specified in the highest units with . delimiter. 10.5 for USD means 10 US Dollars and 50 Cents | Mandatory |

| currency | 3/String | Currency the transaction is charged in (three-letter currency code). Sample values are: USD for US Dollar EUR for European Euro | Mandatory |

| ipaddress | 45/String | Customer’s IP address, included for fraud screening purposes. | Mandatory |

| site_url | 128/String | URL the original sale is made from. | Optional |

| control | 40/String | Checksum generated by SHA-1. See Request authorization through control parameter for more details. | Mandatory |

| redirect_url | 1024/String | URL the cardholder will be redirected to upon completion of the transaction. Please note that the cardholder will be redirected in any case, no matter whether the transaction is approved or declined. You should not use this parameter to retrieve results from Payneteasy gateway, because all parameters go through client’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead. | Mandatory if both redirect_success_url and redirect_fail_url are missing |

| redirect_success_url | 1024/String | URL the cardholder will be redirected to upon completion of the transaction. Please note that the cardholder will be redirected only in case if the transaction is approved. You should not use this parameter to retrieve results from Payneteasy gateway, because all parameters go through client’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead. Pass http://google.com if you use non-3DS schema for transactions processing and you have no need to return customer anywhere. | Mandatory if redirect_url parameter is missing |

| redirect_fail_url | 1024/String | URL the cardholder will be redirected to upon completion of the transaction. Please note that the cardholder will be redirected only in case if the transaction is declined or filtered. You should not use this parameter to retrieve results from Payneteasy gateway, because all parameters go through client’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead. Pass http://google.com if you use non-3DS schema for transactions processing and you have no need to return customer anywhere. | Mandatory if redirect_url parameter is missing |

| server_callback_url | 1024/String | URL the transaction result will be sent to. Merchant may use this URL for custom processing of the transaction completion, e.g. to collect sales data in Merchant’s database. See more details at Merchant Callbacks | Optional |

| preferred_language | 2/String | Customer’s two-letter language code for multi-language payment forms | Optional |

| merchant_form_data | 128/String | Parameters sent in merchant_form_data API parameter are parsed into macros with the same name, the parameter is url-encoded, example: testparam%3Dtest1%26mynewparam%3Dtest2 and is parsed into $MFD_testparam = test1 and $MFD_mynewparam = test2 macros in the form. Parameter name characters[a-zA-Z0-9], parameter value characters[a-zA-Z0-9], control characters [=&], 2MB max size. For example, this parameter can be used to display payment form in light/dark mode depending on the value passed by Connecting Party (e.g. pass merchant_form_data=theme%3Ddark in request and $MFD_theme macro placeholder on payment form will be changed to dark. | Optional |

Additional fields for form transactions¶

Note

Browser data for 3DS 2.X is gathered by Payneteasy system on 3DS authentication stage. For some processing channels, however, the browser data and/or merchant URL for 3DS challenge results must be provided in initial transaction request. Please contact Support manager to clarify if these parameters should be included in request parameters.

The merchant’s site needs to accurately populate the browser information for each transaction. This data can be obtained by merchant’s servers. Ensure that the data is not altered or hard-coded, and that it is unique to each transaction.

| Field Name | Length/Type | Description | Conditional Inclusion |

|---|---|---|---|

| tds_areq_notification_url, alias tds_cres_notification_url | 256/String | Fully qualified URL of merchant system that will receive the CRes message or Error Message. This CRes message must be sent to Payneteasy. See details here Upload CRes Result | Optional |

| customer_browser_info | Boolean | If true, then the fields below must be present | Optional |

| ipaddress | 45/String | IP address of the browser as returned by the HTTP headers to the 3DS Requestor | Required |

| customer_browser_accept_header | 2048/String | Exact content of the HTTP accept headers as sent to the 3DS Requestor from the Cardholder’s browser | Required |

| customer_browser_color_depth | 2/String | Value representing the bit depth of the colour palette for displaying images, in bits per pixel | Required when browser_javaScript_enabled = true; otherwise Optional |

| customer_browser_java_enabled | Boolean | Boolean that represents the ability of the cardholder browser to execute Java | Required when browser_javaScript_enabled = true; otherwise Optional |

| customer_browser_javascript_enabled | Boolean | Boolean that represents the ability of the cardholder browser to execute JavaScript | Required |

| customer_browser_accept_language | 8/String | Value representing the browser language as defined in IETF BCP47 | Required |

| customer_browser_screen_height | 6/Numeric | Total height of the Cardholder’s screen in pixels | Required when browser_javaScript_enabled = true; otherwise Optional |

| customer_browser_screen_width | 6/Numeric | Total width of the cardholder’s screen in pixels | Required when browser_javaScript_enabled = true; otherwise Optional |

| customer_browser_time_zone | 5/String | Time-zone offset in minutes between UTC and the Cardholder browser local time. Note that the offset is positive if the local time zone is behind UTC and negative if it is ahead | Required when browser_javaScript_enabled = true; otherwise Optional |

| customer_browser_user_agent | 2048/String | Exact content of the HTTP user-agent header | Required |

Payment Form Response¶

Response has Content-Type: text/html;charset=utf-8 header. All parameters in response are x-www-form-urlencoded, with (0xA) character at the end of each parameter’s value.А

| Response parameter name | Description |

|---|---|

| type | The type of response. May be async-form-response, validation-error, error. If type equals validation-error or error, error-message and error-code parameters contain error details. |

| paynet-order-id | Order id assigned to the order by Payneteasy |

| merchant-order-id | Merchant order id |

| serial-number | Unique number assigned by Payneteasy server to particular request from the Merchant. |

| error-message | If status is declined or error this parameter contains the reason for decline or error details |

| error-code | The error code in case of declined or error status |

| redirect-url | The URL to the page where the Merchant should redirect the client’s browser. Merchant should send HTTP 302 redirect, see General Payment Form Process Flow |

Payment Form final redirect¶

Upon completion of Payment Form process by the Customer he/she is automatically redirected to redirect_url. The redirection is performed as an HTTPS POST request with the parameters specified in the following table.

| Redirect parameter name | Description |

|---|---|

| status | See Status List for details. |

| orderid | Order id assigned to the order by Payneteasy |

| merchant_order | Merchant order id |

| client_orderid | Merchant order id |

| error_message | If status is declined or error this parameter contains the reason for decline or error details |

| control | Checksum used to ensure that it is Payneteasy (and not a fraudster) that initiates the request. This is SHA-1 checksum of the concatenation status + orderid + client_orderid + merchant-control. |

| descriptor | Gate descriptor |

| processor-tx-id | Acquirer transaction identifier |

| amount | Actual transaction amount. |

| bin | Bank BIN of customer credit card number |

| type | The type of response. |

| card-type | Type of customer credit card |

| phone | Customer phone |

| last-four-digits | Last four digits of customer credit card number |

| card-holder-name | Cardholder name |

| error_code | Error Code |

If Merchant has passed server_callback_url in original Payment Form request Payneteasy will call this URL. Merchant may use it for custom processing of the transaction completion, e.g. to collect sales data in Merchant’s database. The parameters sent to this URL are specified in Sale, Return Callback Parameters

Payment Form Template Sample¶

<html>

<head>

<script type="text/javascript">

function isCCValid(r){var n=r.length;if(n>19||13>n)return!1;

for(i=0,s=0,m=1,l=n;i<l;i++)d=parseInt(r.substring(l-i-1,l-i),10)*m,s+=d>=10?d%10+1:d,1==m?m++:m--;

return s%10==0?!0:!1}

</script>

</head>

<body>

<h3>Order #$!MERCHANT_ORDER_ID - $!ORDERDESCRIPTION</h3>

<h3>Total amount: $!AMOUNT $!CURRENCY to $!MERCHANT</h3>

<form action="${ACTION}" method="post">

<div>Cardholder name: <input name="${CARDHOLDER}" type="text" maxlength="64"/></div>

<div><label for="cc-number">Credit Card Number</label> <input id="cc-number" name="${CARDNO}" type="text" maxlength="19" autocomplete="cc-number"/></div>

<div>Card verification value: <input name="${CVV2}" type="text" maxlength="4" autocomplete="off"/></div>

<div>

Expiration date:

<select class="expiry-month" name="${EXPMONTH}" size="1" autocomplete="cc-exp-month" >

<option value="01">January</option><option value="02">February</option><option value="03">March</option>

<option value="04">April</option><option value="05">May</option><option value="06">June</option>

<option value="07">July</option><option value="08">August</option><option value="09">September</option>

<option value="10">October</option><option value="11">November</option><option value="12">December</option>

</select>

<select class="expiry-year" id="cc-exp-year" name="${EXPYEAR}" size="1" autocomplete="cc-exp-year">

${EXPIRE_YEARS}

</select>

</div>

$!{INTERNAL_SECTION}

#if($!card_error)

<div style="color: red;">$!card_error</div>

#end

<input name="submit" onclick="return isCCValid(document.getElementById('cardnumber').value);" type="submit" value="Pay"/>

</form>

</body>

</html>

Payment form autofill¶

If you want to use autofill in your payment form, certain element attributes <id> <autocomplete> <label for> should be hardcoded in the following manner:

<label for="cc-number">Credit Card Number</label><span class="form-label-comment">The 13-19 digits on the front of your card</span>

<input class="card-number-field" id="cc-number" name="${CARDNO}" type="text" maxlength="19" autocomplete="cc-number" />

Our default payment form template supports autocomplete. In case if you want to add additional fields for autocomplete, this specification should be used for naming references.

Payment form macros¶

| Field Name Macro | Field Value Macro | Description |

|---|---|---|

| ${CARDNO} | ${CARDNOVALUE} | Customer’s credit card number. |

| ${EXPMONTH} | n/a | Credit card expiration month |

| ${EXPYEAR} | n/a | Credit card expiration year |

| ${CVV2} | ${CVV2VALUE} | Card security code 432 |

| ${CARDHOLDER} | ${CARDHOLDER_VALUE} | Card printed name |

| ${MERCHANT} | n/a | End point display name |

| ${SKIN_VERSION} | n/a | CSS skin version |

| ${ORDERDESCRIPTION} | n/a | Order description |

| ${CUSTOMER_FIRST_NAME} | n/a | Customer first name sent by merchant via input parameters |

| ${CUSTOMER_LAST_NAME} | n/a | Customer last name sent by merchant via input parameters |

| ${CUSTOMER_EMAIL} | n/a | Customer E-mail address sent by merchant via input parameters |

| ${AMOUNT} | n/a | Amount |

| ${CURRENCY} | n/a | Currency |

| ${PAYNET_ORDER_ID} | n/a | Payneteasy order id |

| ${MERCHANT_ORDER_ID} | n/a | Merchant order id |

| ${refresh_interval} | n/a | Refresh interval recommended by system |

| ${uuid} | n/a | Internal |

| ${INTERNAL_SECTION} | n/a | Internal for iFrame integration |

| ${CUSTOMER_IP_COUNTRY_ISO_CODE} | n/a | Customer country defined by IP Address |

| ${PREFERRED_LANGUAGE} | n/a | Customer language sent by merchant via input parameters |

| ${BROWSER_LANGUAGE} | n/a | Customer language defined by browser settings |

| ${CUSTOMER_LANGUAGE} | n/a | Customer language sent by merchant via input parameters or defined by browser settings if first is not set |

| ${MERCHANT_FORM_DATA} | n/a | Parameters sent in merchant_form_data API parameter are parsed into macros with the same name, the parameter is url-encoded, example: testparam%3Dtest1%26mynewparam%3Dtest2 and is parsed into $MFD_testparam = test1 and $MFD_mynewparam = test2 macros in the form. Parameter name characters[a-zA-Z0-9], parameter value characters[a-zA-Z0-9], control characters [=&], 2MB max size. For example, this parameter can be used to display payment form in light/dark mode depending on the value passed by Connecting Party (e.g. pass merchant_form_data=theme%3Ddark in request and $MFD_theme macro placeholder on payment form will be changed to dark. |

| ${CUSTOMER_ZIP_CODE} | n/a | Generates a ZIP code to send to the processor if it was not received from the client |

Wait Page Template Sample¶

<html>

<head>

<script type="text/javascript">

function fc(t) {

document.getElementById("seconds-remaining").innerHTML = t;

(t > 0) ? setTimeout(function(){fc(--t);}, 1000) : document.checkform.submit();}

</script>

</head>

<body onload="fc($!refresh_interval)">

<h3>Order #$!MERCHANT_ORDER_ID - $!ORDERDESCRIPTION</h3>

<h3>Total amount: $!AMOUNT $!CURRENCY to $!MERCHANT</h3>

Please wait, your payment is being processed, remaining <span id="seconds-remaining"> </span> seconds.

<form name="checkform" method="post">

<input type="hidden" name="tmp" value="$!uuid"/>

$!{INTERNAL_SECTION}

<input type="submit" value="Check" />

</form>

</body>

</html>

Wait Page macros¶

| Field Name Macro | Field Value Macro | Description |

|---|---|---|

| ${MERCHANT} | n/a | End point display name |

| ${SKIN_VERSION} | n/a | CSS skin version |

| ${ORDERDESCRIPTION} | n/a | Order description |

| ${AMOUNT} | n/a | Amount |

| ${CURRENCY} | n/a | Currency |

| ${PAYNET_ORDER_ID} | n/a | Payneteasy order id |

| ${MERCHANT_ORDER_ID} | n/a | Merchant order id |

| ${refresh_interval} | n/a | Refresh interval recommended by system |

| ${uuid} | n/a | Internal |

| ${INTERNAL_SECTION} | n/a | Internal for iFrame integration |

| ${CUSTOMER_IP_COUNTRY_ISO_CODE} | n/a | Customer country defined by IP Address |

| ${PREFERRED_LANGUAGE} | n/a | Customer language send by merchant via input parameters |

| ${BROWSER_LANGUAGE} | n/a | Customer language defined by browser settings |

| ${CUSTOMER_LANGUAGE} | n/a | Customer language send by merchant via input parameters or defined by browser settings if first is not set |

Finish Page Template Sample¶

<html>

<head>

</head>

<body>

<h3>Processing of the payment has finished</h3>

<h3>Order Invoice: $!{MERCHANT_ORDER_ID}</h3>

<h3>Order ID: $!{PAYNET_ORDER_ID}</h3>

<h3>Status: $!{STATUS}</h3>

#if($ERROR_MESSAGE)

<h3>Error: $!{ERROR_MESSAGE}</h3>

#end

</body>

</html>

Finish Page Macros¶

| Field Name Macro | Field Value Macro | Description |

|---|---|---|

| ${STATUS} | n/a | Order status |

| ${PAYNET_ORDER_ID} | n/a | System order id |

| ${MERCHANT_ORDER_ID} | n/a | Merchant order id |

| ${ERROR_MESSAGE} | n/a | Contains the reason for decline or error details |

| ${SKIN_VERSION} | n/a | CSS skin version |

| ${CUSTOMER_IP_COUNTRY_ISO_CODE} | n/a | Customer country defined by IP Address |

| ${PREFERRED_LANGUAGE} | n/a | Customer language send by merchant via input parameters |

| ${BROWSER_LANGUAGE} | n/a | Customer language defined by browser settings |

| ${CUSTOMER_LANGUAGE} | n/a | Customer language send by merchant via input parameters or defined by browser settings if first is not set |

Request authorization through control parameter¶

The checksum is used to ensure that it is a particular Merchant (and not a fraudster) that initiates the transaction. This SHA-1 checksum, the parameter control, is created by concatenation of the parameters values in the following order:

- ENDPOINTID/ENDPOINTGROUPID

- client_orderid

- minimal monetary units amount (i.e. cent, penny etc. For amount 0.94 USD value in signing string will be 94, for 10.15 USD value in signing string will be 1015)

- merchant_control

A complete string example may look as follows:

59I6email@client.com3E8E45B5-2-42D8-6ECC-FBF6B11B1

Encrypt the string using SHA-1 algorithm. The resultant string yields the control parameter (see Payment Form Request Parameters) which is required for request authorization. For the above-mentioned example the control will take the following value:

d02e67236575a8e02dea5e094f3c8f12f0db43d7

Order status¶

Merchant must use Order status API call to get the customer’s order transaction status. After any type of transaction is sent to Payneteasy server and order id is returned, Merchant should poll for transaction status. When transaction is processed on Payneteasy server side it returns it’s status back to Merchant and at this moment the Merchant is ready to show the customer transaction result, whether it’s approved or declined.

Status API URL¶

For integration purposes use staging environment sandbox.payneteasy.com instead of production gate.payneteasy.com. Status API calls are initiated through HTTPS POST request by using URL in the following format:

Order status call parameters¶

| Status Call Parameter | Description | Necessity |

|---|---|---|

| login | Merchant login name | Mandatory |

| client_orderid | Merchant order identifier of the transaction for which the status is requested | Mandatory |

| orderid | Order id assigned to the order by Payneteasy | Conditional |

| control | Checksum used to ensure that it is Payneteasy (and not a fraudster) that initiates the callback for a particular Merchant. This is SHA-1 checksum of the concatenation login + client-order-id + paynet-order-id + merchant-control. See Order status API call authorization through control parameter for more details about generating control checksum. | Mandatory |

| by-request-sn | Serial number assigned to the specific request by Payneteasy. If this field exist in status request, status response return for this specific request. Include this parameter to get the status response with the particular transaction stage (can be used in specific cases). To get the latest transaction status, don’t include this parameter in status request. | Optional |

Order Status Response¶

Response has Content-Type: text/html;charset=utf-8 header. All parameters in response are x-www-form-urlencoded, with (0xA) character at the end of each parameter’s value.А

| Status Response Parameter | Description |

|---|---|

| type | The type of response. May be status-response |

| status | See Status List for details. |

| amount | Amount of the initial transaction. |

| currency | Currency of the initial transaction. |

| paynet-order-id | Order id assigned to the order by Payneteasy |

| merchant-order-id | Merchant order id |

| phone | Customer phone. |

| serial-number | Unique number assigned by Payneteasy server to particular request from the Merchant. |

| last-four-digits | Last four digits of customer credit card number. |

| bin | Bank BIN of customer credit card number. |

| card-type | Type of customer credit card (VISA, MASTERCARD, etc). |

| gate-partial-reversal | Processing gate support partial reversal (enabled or disabled). |

| gate-partial-capture | Processing gate support partial capture (enabled or disabled). |

| transaction-type | Transaction type (sale, reversal, capture, preauth). |

| processor-rrn | Bank Receiver Registration Number. |

| processor-tx-id | Acquirer transaction identifier. |

| receipt-id | Electronic link to receipt https://gate.payneteasy.com/paynet/view-receipt/ENDPOINTID/receipt-id/ |

| cardholder-name | Cardholder name. |

| card-exp-month | Card expiration month. |

| card-exp-year | Card expiration year. |

| card-hash-id | Unique card identifier to use for loyalty programs or fraud checks. |

| card-country-alpha-three-code | Three letter country code of source card issuer. See Country Codes for details |

| Customer e-mail. | |

| bank-name | Bank name by customer card BIN. |

| terminal-id | Acquirer terminal identifier to show in receipt. |

| paynet-processing-date | Acquirer transaction processing date. |

| approval-code | Bank approval code. |

| order-stage | The current stage of the transaction processing. See Order Stage for details. |

| loyalty-balance | The current bonuses balance of the loyalty program for current operation. if available |

| loyalty-message | The message from the loyalty program. if available |

| loyalty-bonus | The bonus value of the loyalty program for current operation. if available |

| loyalty-program | The name of the loyalty program for current operation. if available |

| descriptor | Bank identifier of the payment recipient. |

| error-message | If status in declined, error, filtered this parameter contains the reason for decline |

| error-code | The error code is case status in declined, error, filtered. |

| by-request-sn | Serial number from status request, if exists in request. Warning parameter amount always shows initial transaction amount, even if status is requested by-request-sn. |

| verified-3d-status | See 3-D Secure Status List for details |

| verified-rsc-status | See Random Sum Check Status List for details |

| transaction-date | Date of final status assignment for transaction. |

Order Status Response Example¶

type=status-response

&serial-number=00000000-0000-0000-0000-0000005b5eec

&merchant-order-id=6132tc

&processor-tx-id=9568-47ed-912d-3a1067ae1d22

&paynet-order-id=161944

&status=approved

&amount=7.56

&descriptor=no

&gate-partial-reversal=enabled

&gate-partial-capture=enabled

&transaction-type=cancel

&receipt-id=2050-3c93-a061-8a19b6c0068f

&name=FirstName

&cardholder-name=FirstName

&card-exp-month=3

&card-exp-year=2028

&email=no

&processor-rrn=510458047886

&approval-code=380424

&order-stage=cancel_approved

&last-four-digits=1111

&bin=444455

&card-type=VISA

&phone=%2B79685787194

&bank-name=UNKNOWN

&paynet-processing-date=2015-04-14+10%3A23%3A34+MSK

&by-request-sn=00000000-0000-0000-0000-0000005b5ece

&card-hash-id=1569311

&verified-3d-status=AUTHENTICATED

&verified-rsc-status=AUTHENTICATED

&transaction-date=2023-01-10+12%3A46%3A28+MSK

Status request authorization through control parameter¶

The checksum is used to ensure that it is Merchant (and not a fraudster) that sends the request to Payneteasy. This SHA-1 checksum, the parameter control, is created by concatenating of the values of the parameters in the following order:

- login

- client_orderid

- orderid

- merchant_control

For example assume the following values are corresponds the parameters above:

| Parameter Name | Parameter Value |

|---|---|

| login | cool_merchant |

| client_orderid | 5624444333322221111110 |

| orderid | 9625 |

| merchant_control | r45a019070772d1c4c2b503bbdc0fa22 |

The complete string example may look as follows:

cool_merchant56244443333222211111109625r45a019070772d1c4c2b503bbdc0fa22

Encrypt the string using SHA-1 algorithm. The resultant string yields the control parameter which is required for authorizing the callback. For the example control above will take the following value:

c52cfb609f20a3677eb280cc4709278ea8f7024c