Acquirer restrictions

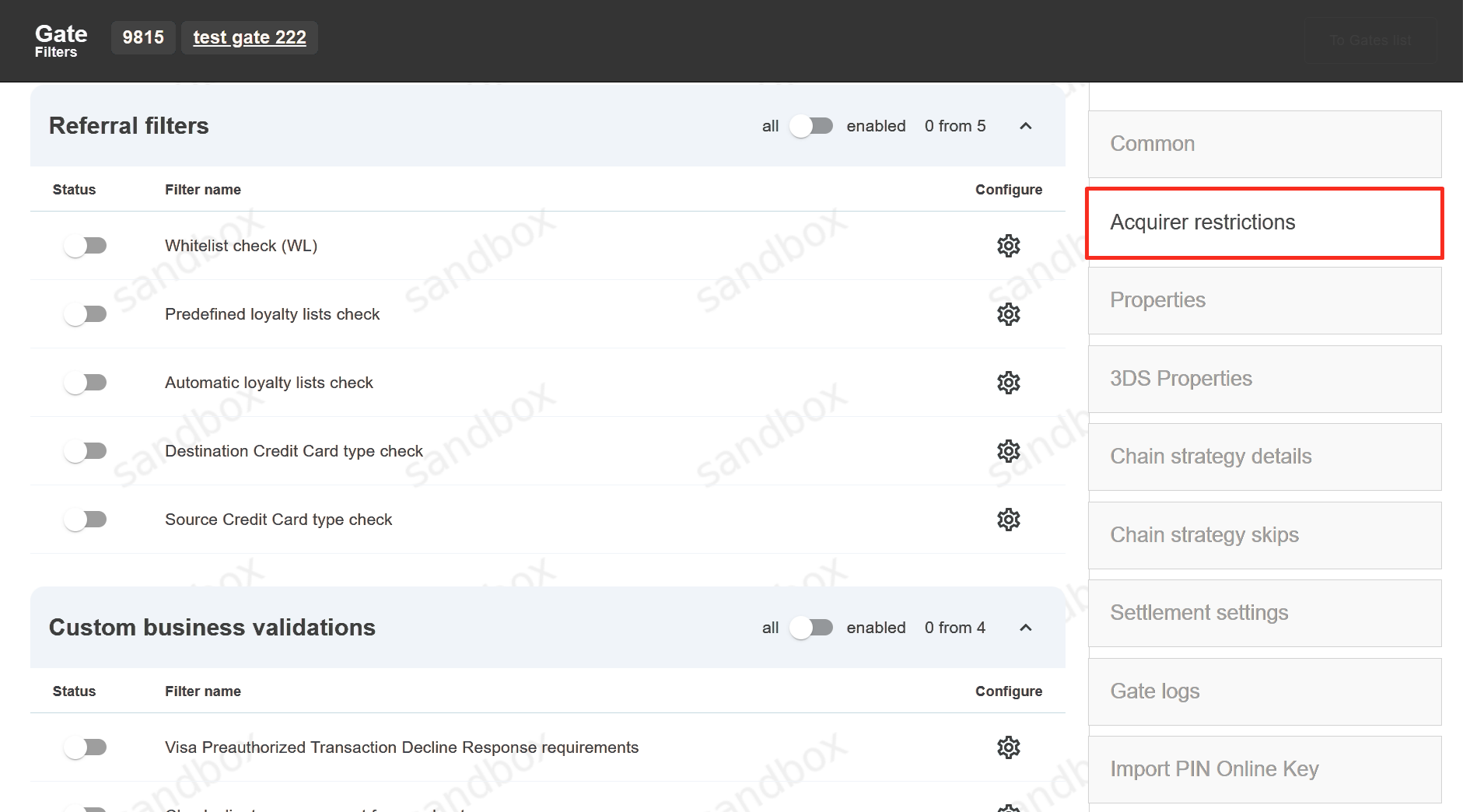

Gate level

This functionality allows to set internal filters and prevent non-successful processing of transactions on gates which have specific limitations. To switch these limitations on, go to the required gate and click on the “Acquirer restrictions” tab.

Warning

If the restriction on the gate is triggered, this gate is removed from balancing block in processing strategy for the current transaction.

Information and reason codes about gates which were excluded from balancing due to triggered restrictions is displayed in transaction details on UI:

API response text for these restrictions can be found on Internal Errors page in Integration section.

Restriction Name |

Comment |

UI code |

|---|---|---|

Whitelist check (WL)

|

Allows ignoring all other Acquirer restrictions for selected Source credit card numbers and Device fingerprints. Sometimes customer’s behavior can lead to the unfortunate situation where a shopper is completely unable to process transactions. You can whitelist a customer’s data so they can successfully process their transaction. White list could be specified for the exact Source card number by manager and the exact Device fingerprint by manager.

|

|

Predefined loyalty lists check

|

Allows processing for trusted customers only. Different acquirers have different definitions of a trusted customer, this filter allows processing for customers with emails, source/destination card or purpose in corresponding loyalty lists only. Transactions for customers that are not listed in any loyalty list will be filtered out.

|

15034

15035

15036

15037

|

Automatic loyalty lists check

|

This filter allows to specify a set of gates (group name) and create subsets of gates (financial instruments) within this set scope to allow processing of transactions with card numbers only on linked subsets of gates. Each card number which is processed by one of the gates within the set (group name) for the first time is linked to the subset (financial instrument) of the gate used for processing. All new transactions with the same card number will be allowed to process only on gates with the linked financial instrument and filtered on all other gates with different financial instruments within the same group name set. If the group name or financial instrument is not indicated on the gate, this filter will not be applied (even if it’s enabled).

|

15110

|

Destination Credit Card type check

|

This referral list allows to block transactions processing for selected Destination Credit Card types (Business, Corporate, etc.)

|

15170

|

Source Credit Card type check

|

This referral list allows to block transactions processing for selected Source Credit Card types (Business, Corporate, etc.)

|

15171

|

Check client approve count for merchant

|

This check fires when the number of transactions associated with exact client for that merchant does not reach the configured thresholds. The client can be identified by card or email address. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15172

|

Check client approve count for manager

|

This check fires when the number of transactions associated with exact client for that manager does not reach the configured thresholds. The client can be identified by card or email address. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15173

|

Source Credit Card Number usage frequency for last 24 hours (daily limit)

|

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15004

15005

|

Source Credit Card Number usage frequency for last 7 days (weekly limit)

|

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15002

15003

|

Source Credit Card Number usage frequency for last month (monthly limit)

|

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15000

15001

|

Source Credit Card Number usage frequency for last 3 months

|

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a window of last 3 calendar months, starting from current month. For window calculation all transaction dates are truncated to months. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 3 months. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15075

15076

|

Source Credit Card Number usage frequency for last 6 months

|

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a window of last 6 calendar months, starting from current month. For window calculation all transaction dates are truncated to months. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 6 months. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15077

15078

|

Source Credit Card Number usage frequency for last 12 months

|

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a window of last 12 calendar months, starting from current month. For window calculation all transaction dates are truncated to months. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 12 months. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15079

15080

|

Purpose usage frequency for last 24 hours (daily limit)

|

This check fires when the number or amount of transactions associated with exact Purpose exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15016

15017

|

Purpose usage frequency for last 7 days (weekly limit)

|

This check fires when the number or amount of transactions associated with exact Purpose exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15014

15015

|

Purpose usage frequency for last month (monthly limit)

|

This check fires when the number or amount of transactions associated with exact Purpose exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15012

15013

|

Email usage frequency for last 24 hours (daily limit)

|

This check fires when the number or amount of transactions associated with exact Email address exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15010

15011

|

Email usage frequency for last 7 days (weekly limit)

|

This check fires when the number or amount of transactions associated with exact Email address exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15008

15009

|

Email usage frequency for last month (monthly limit)

|

This check fires when the number or amount of transactions associated with exact Email address exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15006

15007

|

Visa Preauthorized Transaction Decline Response requirements

|

This check fires for recurring transactions only. Merchants that receive a decline response for a preauthorized transaction will only be allowed to resubmit it for authorization up to four times within 13 calendar days from the date of the original decline response for the same acquirer if the response code is one of the following:

If an approval response is not received within this time frame, merchants must not resubmit the transaction or their acquirers may be subject to non-compliance actions, as outlined in the Visa Rules, and may be subject to chargebacks. Visa Rules to prohibit acquirers and their recurring services merchants from resubmitting a declined transaction for authorization if it receives a pickup response:

or a decline response of

The time threshold is a moving window calculated backwards from the moment of the transaction. Counts Account verification, Sale, Preauth or Transfer transactions in Declined status for listed decline reasons. Correct decline reasons should be supported by a connected PSP. Limits are calculated separately per gate descriptor and not per gate.

|

15023 - CANCEL

15024 - CANCEL

15025 - PICKUP

15026 - DELAY

|

Entire Email usage frequency for last 24 hours (entire daily limit)

|

This check fires when the number or amount of transactions associated with exact Email address exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth or Transfer transactions in any status.

|

15042

15043

|

Entire Email usage frequency for last 7 days (entire weekly limit)

|

This check fires when the number or amount of transactions associated with exact Email address exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth or Transfer transactions in any status.

|

15044

15045

|

Entire Email usage frequency for last month (entire monthly limit)

|

This check fires when the number or amount of transactions associated with exact Email address exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth or Transfer transactions in any status.

|

15046

15047

|

Entire Purpose usage frequency for last 24 hours (entire daily limit)

|

This check fires when the number or amount of transactions associated with exact Purpose exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth or Transfer transactions in any status.

|

15048

15049

|

Entire Purpose usage frequency for last 7 days (entire weekly limit)

|

This check fires when the number or amount of transactions associated with exact Purpose exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth or Transfer transactions in any status.

|

15050

15051

|

Entire Purpose usage frequency for last month (entire monthly limit)

|

This check fires when the number or amount of transactions associated with exact Purpose exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth or Transfer transactions in any status.

|

15052

15053

|

Entire Source Credit Card Number usage frequency for last 24 hours (entire daily limit)

|

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth or Transfer transactions in any status.

|

15054

15055

|

Entire Source Credit Card Number usage frequency for last 7 days (entire weekly limit)

|

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth or Transfer transactions in any status.

|

15056

15057

|

Entire Source Credit Card Number usage frequency for last month (entire monthly limit)

|

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth or Transfer transactions in any status.

|

15058

15059

|

Entire Source Credit Card Number usage frequency for last 3 months (entire 3 months limit)

|

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a window of last 3 calendar months, starting from current month. For window calculation all transaction dates are truncated to months. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 3 months. Counts Sale, Preauth or Transfer transactions in any status.

|

15081

15082

|

Entire Source Credit Card Number usage frequency for last 6 months (entire 6 months limit)

|

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a window of last 6 calendar months, starting from current month. For window calculation all transaction dates are truncated to months. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 6 months. Counts Sale, Preauth or Transfer transactions in any status.

|

15083

15084

|

Entire Source Credit Card Number usage frequency for last 12 months (entire 12 months limit)

|

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a window of last 12 calendar months, starting from current month. For window calculation all transaction dates are truncated to months. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 12 months. Counts Sale, Preauth or Transfer transactions in any status.

|

15085

15086

|

Source Credit Card Number usage frequency for Destination Credit Card Number

|

This check fires when the number of Source Credit Cards associated with exact Destination Credit Card number exceeds the configured thresholds. The time threshold is a moving window calculated backwards from the moment of the transaction. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 Credit Cards in 6 hours, it fires on the 11th unique Credit Card in 6 hours. Counts unique Source Credit Card numbers for Transfer transactions in approved or declined status for the current Gate.

|

15072

|

Declined Email usage frequency for last 24 hours (decline daily limit)

|

This check fires when the number or amount of transactions associated with exact Email address exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth or Transfer transactions in declined status.

|

15066

|

Declined Email usage frequency for last 7 days (decline weekly limit)

|

This check fires when the number or amount of transactions associated with exact Email address exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth or Transfer transactions in declined status.

|

15068

|

Declined Email usage frequency for last month (decline monthly limit)

|

This check fires when the number or amount of transactions associated with exact Email address exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth or Transfer transactions in declined status.

|

15070

|

Source Credit Card Number declined transactions count per period

|

This check fires when the number or amount of transactions associated with exact Account number exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth, Payout or Transfer transactions in the approved status.

|

15125

15126

|

Source Credit Card Number decline frequency for last 24 hours (daily decline limit)

|

This check fires when the number or amount of declined transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Account verification, Sale, Preauth or Transfer transactions in the Declined or Filtered status.

|

|

Source Credit Card Number decline frequency for last week (weekly decline limit)

|

This check fires when the number or amount of declined transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 7 days. Counts Account verification, Sale, Preauth or Transfer transactions in the Declined status.

|

15128

15129

|

Source Credit Card Number decline frequency for last month (monthly decline limit)

|

This check fires when the number or amount of declined transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Account verification, Sale, Preauth or Transfer transactions in the Declined status.

|

15130

15131

|

Destination Credit Card Number decline frequency for last 24 hours (daily decline limit)

|

This check fires when the number or amount of declined transactions associated with exact Destination credit card number exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Transfer transactions in the Declined status.

|

15132

15133

|

Destination Credit Card Number decline frequency for last week (weekly decline limit)

|

This check fires when the number or amount of declined transactions associated with exact Destination credit card number exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Transfer transactions in the Declined status.

|

15134

15135

|

Destination Credit Card Number decline frequency for last month (monthly decline limit)

|

This check fires when the number or amount of declined transactions associated with exact Destination credit card number exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Transfer transactions in the Declined status.

|

15136

15137

|

Total Credit Card Number decline frequency for last 24 hours (daily decline limit)

|

This check fires when the number or amount of declined transactions associated with exact Source or Destination credit card number exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Account verification, Sale, Preauth or Transfer transactions in the Declined status.

|

15138

15139

15140

15141

|

Total Credit Card Number decline frequency for last week (weekly decline limit)

|

This check fires when the number or amount of declined transactions associated with exact Source or Destination credit card number exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Account verification, Sale, Preauth or Transfer transactions in the Declined status.

|

15142

15143

15144

15145

|

Total Credit Card Number decline frequency for last month (monthly decline limit)

|

This check fires when the number or amount of declined transactions associated with exact Source or Destination credit card number exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Account verification, Sale, Preauth or Transfer transactions in the Declined status.

|

15146

15147

15148

15149

|

Source Credit Card Number usage frequency for last N days

|

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a N days window calculated backwards from the moment of the transaction. The N parameter (date period) can be set from 1 to 30. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in N days. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15150

15151

|

Destination Credit Card Number usage frequency for last N days

|

This check fires when the number or amount of transactions associated with exact Destination credit card number exceeds the configured thresholds. The time threshold is a N days window calculated backwards from the moment of the transaction. The N parameter (date period) can be set from 1 to 30. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in N days. Counts Transfer transactions in the approved status.

|

15152

15153

|

Total Credit Card Number usage frequency for last N days

|

This check fires when the number or amount of transactions associated with exact Source or Destination credit card number exceeds the configured thresholds. The time threshold is a N days window calculated backwards from the moment of the transaction. The N parameter (date period) can be set from 1 to 30. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in N days. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15154

15155

15156

15157

|

Purpose usage frequency for last N days

|

This check fires when the number or amount of transactions associated with exact Purpose exceeds the configured thresholds. The time threshold is a N days window calculated backwards from the moment of the transaction. The N parameter (date period) can be set from 1 to 30. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in N days. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15158

15159

|

Email usage frequency for last N days

|

This check fires when the number or amount of transactions associated with exact Email address exceeds the configured thresholds. The time threshold is a N days window calculated backwards from the moment of the transaction. The N parameter (date period) can be set from 1 to 30. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in N days. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15160

15161

|

IP address usage frequency for last N days

|

This check fires when the number or amount of transactions associated with exact IP address exceeds the configured thresholds. The time threshold is a N days window calculated backwards from the moment of the transaction. The N parameter (date period) can be set from 1 to 30. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in N days. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15162

15163

|

Fingerprint usage frequency for last N days

|

This check fires when the number or amount of transactions associated with exact Fingerprint exceeds the configured thresholds. The time threshold is a N days window calculated backwards from the moment of the transaction. The N parameter (date period) can be set from 1 to 30. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in N days. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15164

15165

|

Account Number usage frequency for last N days

|

This check fires when the number or amount of transactions associated with exact Account Number exceeds the configured thresholds. The time threshold is a N days window calculated backwards from the moment of the transaction. The N parameter (date period) can be set from 1 to 30. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in N days. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15166

15167

|

BIN range usage frequency

|

This check fires when the number of transactions associated with the specific card BIN range exceeds the configured thresholds, also can specify a list of card BIN range exceptions for which checks will not be performed. The maximum time threshold is a 300 seconds window, calculated backwards from the moment of the first transaction. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 300 seconds. Counts Sale, Preauth, Payouts or Transfer transactions.

|

15119

|

Issuer country usage frequency

|

This check fires when the number of transactions associated with the same card issuer country exceeds the configured thresholds. The maximum time threshold is a 300 seconds window, calculated backwards from the moment of the first transaction. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 300 seconds. Counts Sale, Preauth, Payouts or Transfer transactions.

|

15114

|

Preventing transaction with the same amount

|

This check fires when more than one transaction is made with same amount in a time threshold (in seconds). The maximum time threshold is a 300 seconds window, calculated backwards from the moment of the first transaction. The risk fires on the second transaction with the same amount during set time threshold. Counts Sale, Preauth, Payouts or Transfer transactions.

|

15113

|

Customer IP address Country differs from Issuing Country

|

This risk check fires when the customer IP country different from the issuing country of the card. Requests from IP addresses listed in “Merchant API IP address” are ignoring this check. If parameter “apply for countries” is empty, filter will require strict customer country to issuer country matching for all the countries, otherwise this check will force country matching for listed countries only. For example if you setup “apply for countries” to US - check will be triggered for following country combinations US-anyNonUS or anyNonUS-US, but for combinations anyNonUS-anyNonUS and US-US the check will not fire. For card2card transactions issuer country of the source card should be equal to issuer country of the destination card, i.e. this check will be triggered for any cross-border transaction.

|

15116

|

Purpose usage frequency for last year (annual limit)

|

This check fires when the number or amount of transactions associated with exact Purpose exceeds the configured thresholds. The time threshold is a one year window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 100 transactions, it fires on the 101th transaction in one year. Calculation of the year can be started from the beginning of the calendar year or from the filter activation truncated to the month and -12 months. I.e. if you activated the filter on May 15, 2021, the filter will consider transactions from May 2020. Counts Sale, Preauth or Transfer transactions in the approved status.

|

15117

15118

|

Transaction number per period

|

This check fires when the number of transactions exceeds the configured thresholds. The maximum time threshold is a 600 seconds window, calculated backwards from the moment of the first transaction. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction during 600 seconds. Counts Sale, Preauth, Payouts or Transfer transactions.

|

15115

|

Minimum time between transactions in the acquirer

|

This check fires when more than one transaction is made with same card in the same financial instrument in a time threshold (in minutes). The maximum time threshold is a 120 minutes window, calculated backwards from the moment of the first transaction. The filter takes into consideration only approved transactions. The risk fires on the second transaction with the same card during set time threshold. Counts Sale and Transfer transactions.

|

15120

|

Account Number usage frequency for last 24 hours (daily limit)

|

This check fires when the number or amount of transactions associated with exact Account number exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth, Payout or Transfer transactions in the approved status.

|

15121

15122

|

Account Number usage frequency for last 7 days (weekly limit)

|

This check fires when the number or amount of transactions associated with exact Account number exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth, Payout or Transfer transactions in the approved status.

|

15123

15124

|

Account Number usage frequency for last month (monthly limit)

|

This check fires when the number or amount of transactions associated with exact Account number exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth, Payout or Transfer transactions in the approved status.

|

15125

15126

|

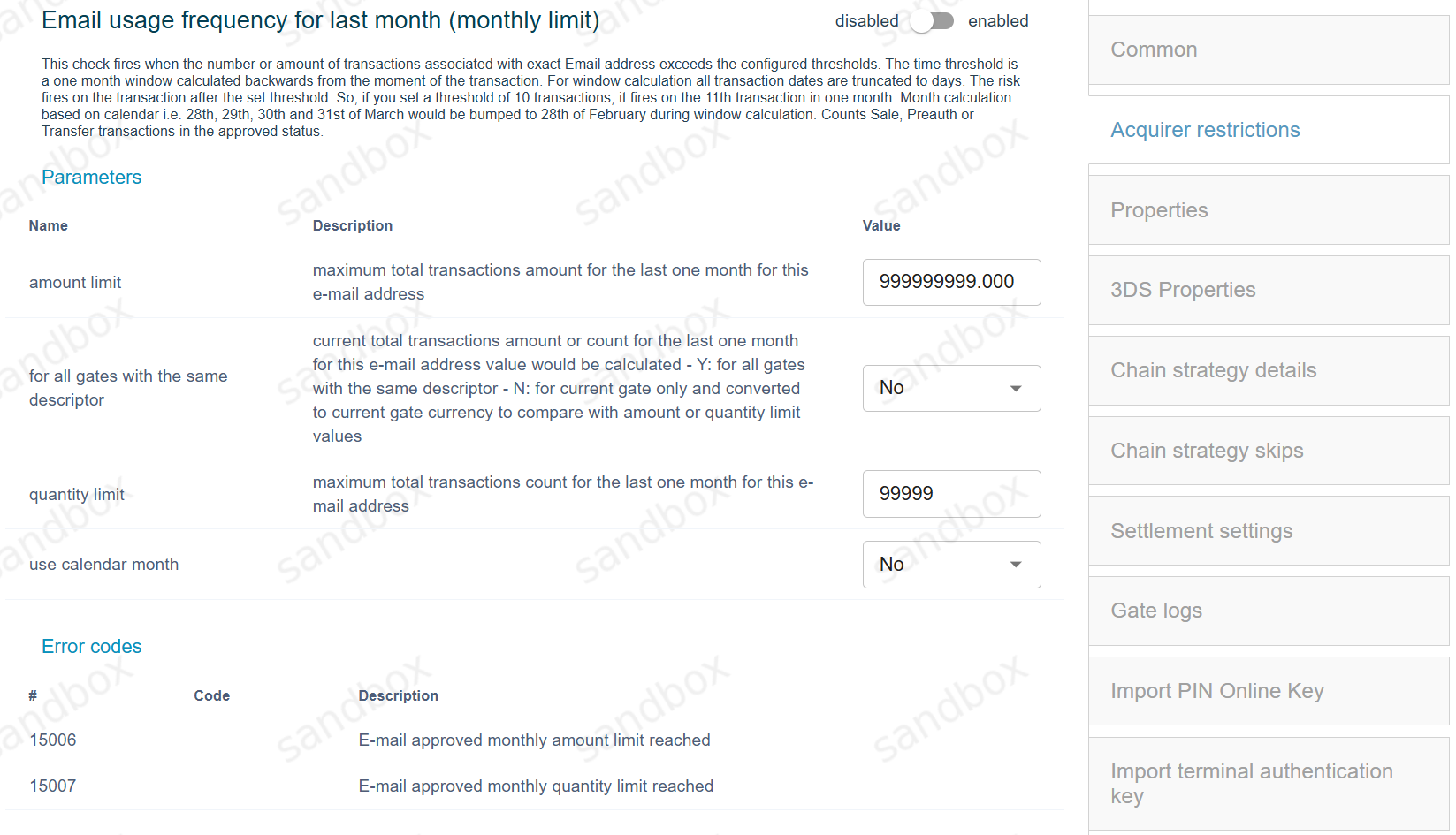

Below is the example of configuration for “Email usage frequency for last month (monthly limit)” restriction. To switch this restriction on, click on the toggle button near it’s name:

This restriction supports the following settings:

The Amount limit maximum total transactions amount for the last one month for this e-mail address. Value: total amount value.

For all gates with the same descriptor – current total transactions amount or count for the last one month for this e-mail address value would be calculated and converted to current gate currency to compare with amount or quantity limit. Specify the value “Y” (Yes) instead of “N” (No) to enable. Values: Y: for all gates with the same descriptor, N: for current gate only.

The quantity limit parameter specifies the transactions quantity limits. Value: total quantity value.

Use calendar month : Value: Y/N.

The choice of “Country Identifier” will be available in the “Deny” restriction configurations.

Each country is assigned its own numerical identifier. The required country can be chosen from the list.

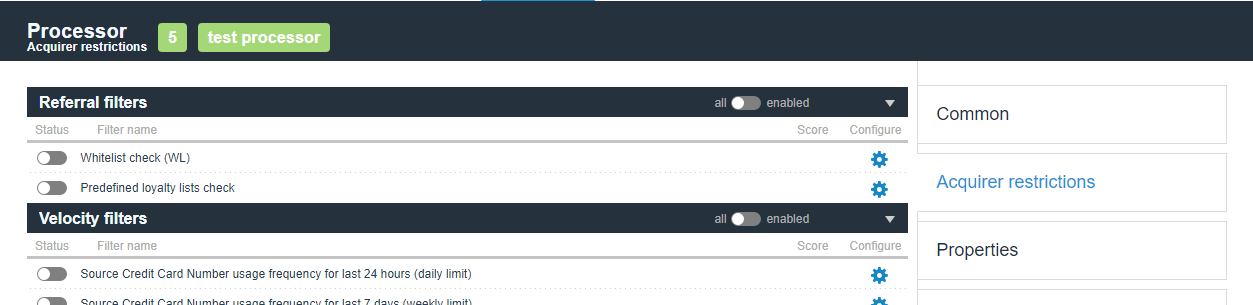

Processor level

This functionality allows to prevent non-successful processing of transactions on all gates of the same processor which have specific limitations. To switch them on, go to the required processor and click on the “Acquirer restrictions” tab. Tab will be available only for manager account and linked superiors.

Restriction Name |

Comment |

UI code and reason |

|---|---|---|

Whitelist check (WL)

|

Allows ignoring all other Acquirer restrictions for selected Source credit card numbers and Device fingerprints. Sometimes customer’s behavior can lead to the unfortunate situation where a shopper is completely unable to process transactions. You can whitelist a customer’s data so they can successfully process their transaction. White list could be specified for: the exact Source card number by manager, the exact Device fingerprint by manager

|

|

Predefined loyalty lists check

|

Allows processing for trusted customers only. Different acquirers have different definitions of a trusted customer, this filter allows processing for customers with emails, source/destination card or purpose in corresponding loyalty lists only. Transactions for customers that are not listed in any loyalty list will be filtered out..

|

18042 - Proccessor loyal source card number check failed

18043 - Proccessor loyal destination card number check failed

|

Destination Credit Card type check

|

This referral list allows to block transactions processing for selected Destination Credit Card types (Business, Corporate, etc).

|

18112 - Proccessor unsupported destination product type

|

Source Credit Card type check

|

This referral list allows to block transactions processing for selected Source Credit Card types (Business, Corporate, etc).

|

18113 - Proccessor unsupported product type

|

Check client approve count for merchant

|

This check fires when the number of transactions associated with exact client for that merchant does not reach the configured thresholds. The client can be identified by card or email address. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18116 - Processor required number of approvals for merchant has not achieved

|

Check client approve count for manager

|

This check fires when the number of transactions associated with exact client for that manager does not reach the configured thresholds. The client can be identified by card or email address. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18117 Processor required number of approvals for manager has not achieved

|

Source Credit Card Number usage frequency for last 24 hours (daily limit)

|

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth or Transfer transactions in the approved status. Timeframe can be set to calendar day instead of 24 hours window.

|

18004 - Approved hourly amount limit reached

18005 - Approved hourly quantity limit reached

|

Source Credit Card Number usage frequency for last 7 days (weekly limit)

|

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18002 - Approved weekly amount limit reached

18003 - Approved weekly quantity limit reached

|

Source Credit Card Number usage frequency for last month (monthly limit)

|

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18000 - Approved monthly amount limit reached

18001 - Approved monthly quantity limit reached

|

Source Credit Card Number decline frequency for last 7 days (decline weekly limit)

|

This check fires when the number of declined transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth or Transfer transactions in declined status.

|

18058 - Weekly decline quantity limit exceeded for the same credit card number on processor

18059 - Weekly decline amount limit exceeded for the same credit card number on processor

|

Source Credit Card Number decline frequency for last month (decline monthly limit)

|

This check fires when the number of declined transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18060 - Monthly decline quantity limit exceeded for the same credit card number on processor

18061 - Monthly decline amount limit exceeded for the same credit card number on processor

|

Destination Credit Card Number usage frequency for last 24 hours (daily limit)

|

This check fires when the number or amount of transactions associated with exact Destination credit card number exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Transfer transactions only in the approved status.

|

18032 - Destination approved hourly amount limit reached

18033 - Destination approved hourly quantity limit reached

|

Destination Credit Card Number usage frequency for last 7 days (weekly limit)

|

This check fires when the number or amount of transactions associated with exact Destination credit card number exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Transfer transactions only in the approved status.

|

18030 - Destination approved weekly amount limit reached

18031 - Destination approved weekly quantity limit reached

|

Destination Credit Card Number usage frequency for last month (monthly limit)

|

This check fires when the number or amount of transactions associated with exact Destination credit card number exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Transfer transactions only in the approved status.

|

18028 - Destination approved monthly amount limit reached

18029 - Destination approved monthly quantity limit reached

|

Total Credit Card Number usage frequency for last 24 hours (daily limit)

|

This check fires when the number or amount of transactions associated with exact credit card number used as Source or Destination exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18038 - Total approved hourly amount limit reached

18039 - Total approved hourly quantity limit reached

|

Total Credit Card Number usage frequency for last 7 days (weekly limit)

|

This check fires when the number or amount of transactions associated with exact credit card number used as Source or Destination exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18036 - Total approved weekly amount limit reached

18037 - Total approved weekly quantity limit reached

|

Total Credit Card Number usage frequency for last month (monthly limit)

|

This check fires when the number or amount of transactions associated with exact credit card number used as Source or Destination exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18034 - Total approved monthly amount limit reached

18035 - Total approved monthly quantity limit reached

|

Email usage frequency for last 24 hours (daily limit)

|

This check fires when the number or amount of transactions associated with exact Email address exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18010 - E-mail approved hourly amount limit reached

18011 - E-mail approved hourly quantity limit reached

|

Email usage frequency for last 7 days (weekly limit)

|

This check fires when the number or amount of transactions associated with exact Email address exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18008 - E-mail approved weekly amount limit reached

18009 - E-mail approved weekly quantity limit reached

|

Email usage frequency for last month (monthly limit)

|

This check fires when the number or amount of transactions associated with exact Email address exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18006 - E-mail approved monthly amount limit reached

18007 - E-mail approved monthly quantity limit reached

|

Email usage lifetime

|

Allows to limit the number and amount of transactions available to an individual customer and set a limit on the processor for the ALL time of existence. Customer is determined by E-Mail. This check fires when the number or amount of transactions associated with exact Email address exceeds the configured thresholds. The time period is lifetime. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18048 - E-mail approved lifetime amount limit reached

18049 - E-mail approved lifetime quantity limit reached

|

Customer IP usage frequency for last 24 hours (daily limit)

|

This check fires when the number or amount of transactions associated with exact Customer IP address exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18022 - Customer IP approved hourly amount limit reached

18023 - Customer IP approved hourly quantity limit reached

|

Customer IP usage frequency for last 7 days (weekly limit)

|

This check fires when the number or amount of transactions associated with exact Customer IP address exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18020 - Customer IP approved weekly amount limit reached

18021 - Customer IP approved weekly quantity limit reached

|

Customer IP usage frequency for last month (monthly limit)

|

This check fires when the number or amount of transactions associated with exact Customer IP address exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18018 - Customer IP approved monthly amount limit reached

18019 - Customer IP approved monthly quantity limit reached

|

Purpose usage frequency for last 24 hours (daily limit)

|

This check fires when the number or amount of transactions associated with exact Purpose exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18016 - Purpose approved hourly amount limit reached

18017 - Purpose approved hourly quantity limit reached

|

Purpose usage frequency for last 7 days (weekly limit)

|

This check fires when the number or amount of transactions associated with exact Purpose exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18014 - Purpose approved weekly amount limit reached

18015 - Purpose approved weekly quantity limit reached

|

Purpose usage frequency for last month (monthly limit)

|

This check fires when the number or amount of transactions associated with exact Purpose exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18012 - Purpose approved monthly amount limit reached

18013 - Purpose approved monthly quantity limit reached

|

BIN range usage frequency

|

This check fires when the number of transactions associated with the specific card BIN range exceeds the configured thresholds, also can specify a list of card BIN range exceptions for which checks will not be performed. The maximum time threshold is a 300 seconds window, calculated backwards from the moment of the first transaction. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 300 seconds. Counts Sale, Preauth, Payouts or Transfer transactions.

|

18056 - Transaction quantity limit exceeds by BIN range on processor

|

Issuer country usage frequency

|

This check fires when the number of transactions associated with the same card issuer country exceeds the configured thresholds. The maximum time threshold is a 300 seconds window, calculated backwards from the moment of the first transaction. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 300 seconds. Counts Sale, Preauth, Payouts or Transfer transactions.

|

18053 - Transactions quantity limit exceeds by country on processor

|

Preventing transaction with the same amount

|

This check fires when more than one transaction is made with same amount in a time threshold (in seconds). The maximum time threshold is a 300 seconds window, calculated backwards from the moment of the first transaction. The risk fires on the second transaction with the same amount during set time threshold. Counts Sale, Preauth, Payouts or Transfer transactions.

|

18052 - Same amount request on processor

|

Transaction number per period

|

This check fires when the number of transactions exceeds the configured thresholds. The maximum time threshold is a 600 seconds window, calculated backwards from the moment of the first transaction. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction during 600 seconds. Counts Sale, Preauth, Payouts or Transfer transactions.

|

18057 - Detected transaction in the set threshold of time

|

Account Number usage frequency for last 24 hours (daily limit)

|

This check fires when the number or amount of transactions associated with exact Account number exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth, Payout or Transfer transactions in the approved status.

|

15121

15122

|

Account Number usage frequency for last 7 days (weekly limit)

|

This check fires when the number or amount of transactions associated with exact Account number exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth, Payout or Transfer transactions in the approved status.

|

15123

15124

|

Account Number usage frequency for last month (monthly limit)

|

This check fires when the number or amount of transactions associated with exact Account number exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth, Payout or Transfer transactions in the approved status.

|

15125

15126

|

Destination Credit Card Number decline frequency for last 24 hours (daily decline limit)

|

This check fires when the number or amount of declined transactions associated with exact Destination credit card number exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Transfer transactions in the Declined status.

|

18068 - Daily decline amount limit exceeded for the recipient on processor

18069 - Daily decline quantity limit exceeded for the recipient on processor

|

Destination Credit Card Number decline frequency for last week (weekly decline limit)

|

This check fires when the number or amount of declined transactions associated with exact Destination credit card number exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Transfer transactions in the Declined status.

|

18070 - Weekly decline amount limit exceeded for the recipient on processor

18071 - Weekly decline quantity limit exceeded for the recipient on processor

|

Destination Credit Card Number decline frequency for last month (monthly decline limit)

|

This check fires when the number or amount of declined transactions associated with exact Destination credit card number exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Transfer transactions in the Declined status.

|

18072 - Monthly decline amount limit exceeded for the recipient on processor

18073 - Monthly decline quantity limit exceeded for the recipient on processor

|

Total Credit Card Number decline frequency for last 24 hours (daily decline limit)

|

This check fires when the number or amount of declined transactions associated with exact Source or Destination credit card number exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Account verification, Sale, Preauth or Transfer transactions in the Declined status.

|

18074 - Daily decline total amount limit exceeded for the sender on processor

18075 - Daily decline total quantity limit exceeded for the sender on processor

18076 - Daily decline total amount limit exceeded for the recipient on processor

18077 - Daily decline total quantity limit exceeded for the recipient on processor

|

Total Credit Card Number decline frequency for last week (weekly decline limit)

|

This check fires when the number or amount of declined transactions associated with exact Source or Destination credit card number exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Account verification, Sale, Preauth or Transfer transactions in the Declined status.

|

18078 - Weekly decline total amount limit exceeded for the sender on processor

18079 - Weekly decline total quantity limit exceeded for the sender on processor

18080 - Weekly decline total amount limit exceeded for the recipient on processor

18081 - Weekly decline total quantity limit exceeded for the recipient on processor

|

Total Credit Card Number decline frequency for last month (monthly decline limit)

|

This check fires when the number or amount of declined transactions associated with exact Source or Destination credit card number exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Account verification, Sale, Preauth or Transfer transactions in the Declined status.

|

18082 - Monthly decline total amount limit exceeded for the sender on processor

18083 - Monthly decline total quantity limit exceeded for the sender on processor

18084 - Monthly decline total amount limit exceeded for the recipient on processor

18085 - Monthly decline total quantity limit exceeded for the recipient on processor

|

Source Credit Card Number usage frequency for last N days

|

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a N days window calculated backwards from the moment of the transaction. The N parameter (date period) can be set from 1 to 30. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in N days. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18086 - Approved specified period amount limit reached

18087 - Approved specified period quantity limit reached

|

Destination Credit Card Number usage frequency for last N days

|

This check fires when the number or amount of transactions associated with exact Destination credit card number exceeds the configured thresholds. The time threshold is a N days window calculated backwards from the moment of the transaction. The N parameter (date period) can be set from 1 to 30. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in N days. Counts Transfer transactions in the approved status.

|

18088 - Approved specified period amount limit reached,

18089 - Approved specified period quantity limit reached

|

Total Credit Card Number usage frequency for last N days

|

This check fires when the number or amount of transactions associated with exact Source or Destination credit card number exceeds the configured thresholds. The time threshold is a N days window calculated backwards from the moment of the transaction. The N parameter (date period) can be set from 1 to 30. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in N days. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18090 - Total specified period amount limit reached

18091 - Total specified period quantity limit reached

18092 - Total specified period amount limit reached for recipient

18093 - Total specified period quantity limit reached for recipient

|

Purpose usage frequency for last N days

|

This check fires when the number or amount of transactions associated with exact Purpose exceeds the configured thresholds. The time threshold is a N days window calculated backwards from the moment of the transaction. The N parameter (date period) can be set from 1 to 30. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in N days. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18094 - Purpose approved specified period amount limit reached

18095 - Purpose approved specified period quantity limit reached

|

Email usage frequency for last N days

|

This check fires when the number or amount of transactions associated with exact Email address exceeds the configured thresholds. The time threshold is a N days window calculated backwards from the moment of the transaction. The N parameter (date period) can be set from 1 to 30. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in N days. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18096 - E-mail approved specified period amount limit reached

18097 - E-mail approved specified period quantity limit reached

|

IP address usage frequency for last N days

|

This check fires when the number or amount of transactions associated with exact IP address exceeds the configured thresholds. The time threshold is a N days window calculated backwards from the moment of the transaction. The N parameter (date period) can be set from 1 to 30. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in N days. Counts Sale, Preauth or Transfer transactions in the approved status.

|

18098 - IP address approved specified period amount limit reached

18099 - IP address approved specified period quantity limit reached

|

Fingerprint usage frequency for last N days

|